Category: Uncategorized

Risk Parity

Risk parity has been one of the most important advancements in portfolio construction over the last decade. It places the focus on equalization of risk and not on comparing expected returns which are notorious for being difficult to forecast. However, there is a problem with risk parity. It will allocate more to low risk asset classes that may be subject to a downturn. There is no opinion on market direction or valuation. It assumes the investor has no information on individual assets or view of factor risks. Outperformance relative to cap weighted portfolio is related to whether low risk assets have returns than higher risk assets.

International Finance

International finance has been increasingly confusing for academics, policy-makers, and traders. Just when you think currency markets will be well-behaved and follow theory, they will move in ways that are totally unexpected. We have always known that currencies are hard to predict given they are expectational markets. Even with perfect foresight about underlying fundamentals, our ability to explain currency is suspect. The research continues to show that currencies are hard to predict and fundamental models can only explain a small percentage of the price variation. There needs to be a deeper framework for understanding foreign exchange behavior.

Minksy, Volatility, and Skew

The Financial Crisis resurrected the thinking of Hyman Minsky and his “financial instability hypothesis”. With the crisis, there was coined the term Minsky Moment, the time when financial markets collapse after a period of prosperity from the excessive speculation on financial assets. Unfortunately, his insightful views on financial instability never received the attention it deserved before the crisis. It was not structured in the current economic orthodoxy of formal mathematical modeling.

Forgetfulness and Financial Analysis – Is More Memory Always Better?

Big historical events, especially tragedies, are committed to memory so we will not forget, yet is it really good to remember everything? Put differently, is forgetfulness useful? Would we be better off if some memories disappeared?

Financial Analysis and “Truthiness” – Follow Data, Not the Talk

If I were being polite, I would not argue that we are in an age of lies by politicians, businessmen, or leaders, but what The Economist has called a “post-truth world”. Stephen Colbert described the current environment as one of different levels of “truthiness”. At best, clarity by leaders and spokespeople is in short supply. Most commentary is done for spin.

Probability of Recession Rising – A Warning

The US recession probability model based on the Treasury spread is a simple straightforward forecasting tool that can be followed in real time. If the spread term negative, watch out, economic winter is coming. Nevertheless, there are only a limited number of recessions and a limited number of signals. What is as useful is watching how the probability of a recession changes during non-recession periods. Periods of growing economic stress will see an increase in recession probability. For example, periods when the probability is more than 10% or even more than 5% will be times when equity markets will be under stress. These periods may pass without a recession, but there will be an impact on financial markets. This signal may have to be confirmed with other data since it provides early warnings, but it is valuable as a simple indicator.

Gemini Alt & IASG Alternatives Announce Technology Integration

CHICAGO, Sept. 13, 2016 /PRNewswire/ — The Gemini Companies announces that its affiliate, Gemini Alternative Funds, LLC (http://www.geminialt.com), has completed a software integration with IASG Alternatives LLC. As part of a strategic relationship, prospective Gemini Alt investors will have access to the IASG Alternatives managed futures database without leaving Gemini Alt’s Galaxy Plus managed account […]

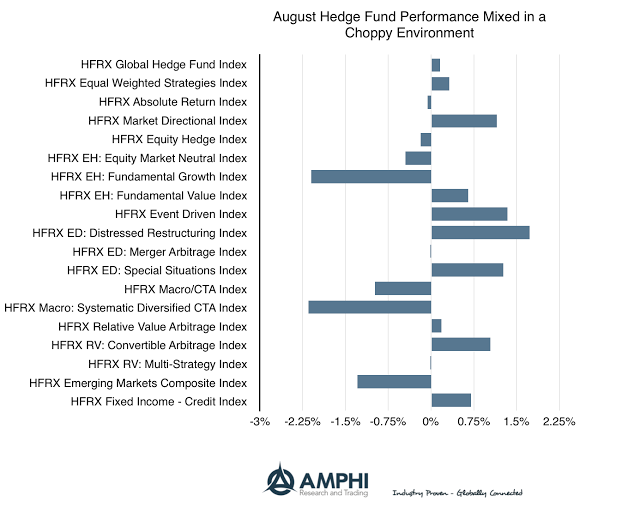

Hedge Funds Performance Shows Dispersion in August and for the Year

2016 is a year is turning out to be special for relative value hedge funds focused on distressed and event driven strategies. These two along with special situations, equity market direction, and convertible arbitrage moved to be the August winner. The losers for the month were fundamental growth and systematic CTA’s. Both these strategies need movement in economic or firm-specific fundamentals which just did not occur for the month. Relative to the flat equity and fixed income markets, August performance for hedge funds was at best fair.

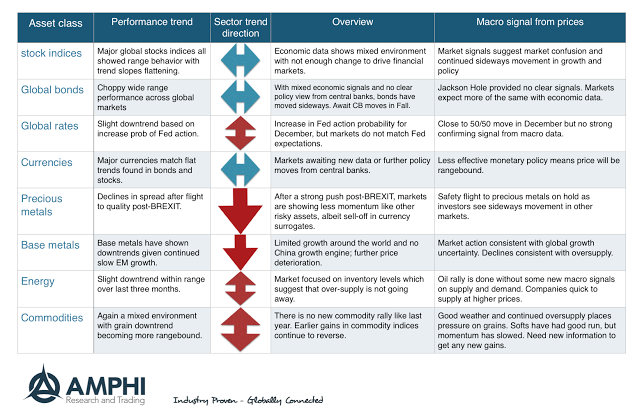

Lack of Trends Across Major Asset Sectors

The reason for the lackluster performance of managed futures is clear from a review of trends for the major sectors. For stock indices, global bonds, and currencies, the big three asset classes, there were no clear trends for the month. Global rates, energy, and commodities also showed sideways movement albeit with a slight downward tilt. The only sectors that showed any real direction were precious and base metals that moved lower.

CTAs Stung by Low Volatility in August

Following a flat July, CTAs struggled in August. A concomitance of low volatility, range bound markets, lack of follow through on existing trends, as well as an emergence of new trends, resulted in negative performance for several managers. The extremely low volatility environment was challenging for most systematic managers as their strategies had little to work with. This absence of any meaningful follow through resulted in a portion of previously accrued gains being absorbed back into the markets.

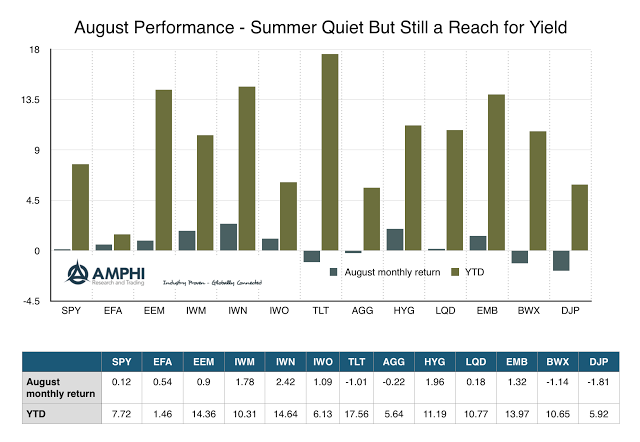

Review of Asset Classes

For many it was a hot August. Time to slowdown, go on holiday, and not worry about financial markets. Of course, there is a lot to worry about, but August performance across most asset classes showed general range-bound behavior with a continued reach for yield within the equity and fixed income asset classes. The tight range was linked to no substantive news to change expectations. After weeks of hype, the comments of Fed Chairman Yellen at the Jackson Hole conference did not serve up anything new. The data driven Fed may raise rates or not based on further confirmation of data that seems stuck in a range.

Looking for a Turn in Both Government Bonds and the Japanese Yen

In quite a few ways, recent weeks have been anything but boring. Trying to filter out important events from random noise in markets today feels like a bit of a mugs game, but that shouldn’t stop us from trying if we think that we can add some value to our investors. We would like to pick up on a couple of areas that are gaining our attention, and we’re certainly not alone, so here goes with our version of events.

IASG Launches Broker Dealer to Serve an Expanding Audience for Managed Futures

IASG Alternatives was founded in 2015 by current IASG team members Perry Jonkheer, JonPaul Jonkheer, and portfolio managers, Tyler Resch and Greg Taunt. This new company adds to the services provided by Institutional Advisory Services Group (IASG) by offering futures fund and managed account platform products designed to fit the risk tolerance, diversification, and transparency needs of our customers. Our free portfolio review process consists of an initial consultation, research and evaluation of managers that fit prospective customer’s risk return profile, portfolio design, and ultimately daily monitoring and reporting once an investment is open. Through education and proper manager selection we believe futures are an option that everyone should be knowledgeable about as a potential diversifier for their traditional investments.