Category: Uncategorized

Arbitrage and Ethics – Food for Thought

I don’t think many finance professionals would link arbitrage and ethics together. There is an ethical link between being a fiduciary and handling money for clients. Trade organizations and MBA schools will tie business practices, ethics, and being a fiduciary, but you would not expect discussion of ethics matched with talks on arbitrage, but Maureen O’Hara, a esteemed professor of finance at Cornell University has done just that with her new book Something for Nothing: Arbitrage and Ethics on Wall Street.

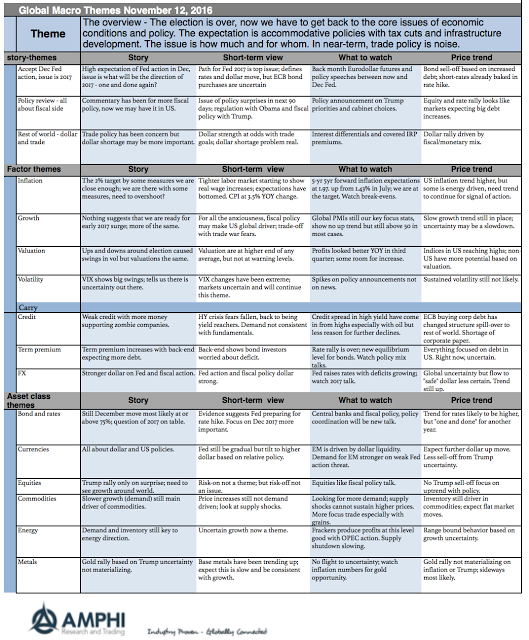

Global Themes on One Page

We have delayed our monthly global themes on one page given the US presidential election. There was too much uncertainty associated with the election to focus on the core themes of growth and valuation. Now that the election is over, we can focus on what is most important, growth, liquidity, and risk appetite. Financial markets are driven by the underlying economics of policies and not the personality of the president. Focus on policy, not the man. Personality matters to the degree that policy agendas can be moved. This is not trivial, but what moves markets are the policies. The key is determining what will get done, when, and how much. These policies have to be balanced with growth prospects around the world.

Liquidity Premium – Not Easy to Sort-Out

There is a strong demand for liquidity in all investments even hedge funds. However, there is a difference in the liquidity across hedge fund styles. The key investment question is whether you get paid to hold less liquidity. Is there an illiquidity premium?

Sector Exposures

October was a painful month for investors with no place to hide in many sectors, styles, countries, or bonds. Major equity styles declined significantly especially in small caps.

Quantitative Analysis

A provocative post by Peter Lupoff the founder of Tiburon Capital called “When numbers cloud meaning – The fallacy of investment research exactitude” has me thinking about narrative versus the idea of false precision with quantitative analysis. First, something to put the issue into context; a classic joke on false precision, “I am 98.54% certain that you need both precision and narrative to be an effective trader.”

Crunch Time in Bond Markets Makes Equities More Vulnerable

Since the post Brexit plunge in bond yields, we have been becoming more negative on bonds. Along with virtually everyone, except central bankers, we have been banging the drum of how insane negative bond yields are. However, with many institutional investors required to hold Government bonds due to regulatory and capital requirements, and central bank’s QE exceeding global Government bond supply, it was almost understandable how bond yields could remain in sub-zero terrain. Understandable yes, but that did not make them good investments!

Cognitive Biases

The list of cognitive biases that can affect investors keeps growing. An explosion of studies show that observed decision-making under real and test conditions is hard. Just look at the wheel from Buster Bensen’s cognitive bias cheat sheet, the single best graphic I have seen which lists and categorizes the cognitive biases investors face, to get a flavor of the problem. Nevertheless, this work does a good job of reducing all of these biases into four problem categories:

Can The World Cope With a Resurgent Dollar?

There is no doubt that big swings in the value of the US Dollar have a big impact on global economic growth and also financial markets performances. Between June 2014 and January 2016, as the Dollar rose by over 20%, global equity markets struggled (Emerging Markets suffering the most), commodity prices plunged and deflationary concerns moved front and center. After the Dollar topped in late January, everything has turned around. The Dollar has traded sideways, financial markets have performed pretty well overall and economic concerns have abated. Although it cannot all be about the Dollar, we need to recognize that the Dollar is extremely important for both financial markets and the global economy.

Investment Consultants

Investment consultants are a force to the reckoned with in the pension world. They advise and drive many pension decisions around the globe.

Central Banking

The modern financial world could not exist without effective central banking. The foundation of this core invention is a trust in banking; a trust that a paper claim can be used as a medium of exchange and a store of value…

The End of Alchemy

I finished reading The End of Alchemy: Banking, the Global Economy and the Future of Money and came away with some useful but simple insights on the current state of finance by the author Melvyn King.

Hedge Fund Classification

All hedge fund strategies are not created equal. Correct hedge fund classification is important. Poor classification will generate false conclusions on the skill of the manager and may deliver return streams that are unexpected. Asset allocation becomes more difficult if classification is ineffective.

August Calm Gives Way to Limited Opportunities for Managed Futures

September came and went with a relative whimper. It was our view that various key macro events scheduled throughout the month coupled with uncertainty over monetary policy, had the potential to produce significant moves across global markets. As it turned out..with the exception of the commodities sector…this was not the case. U.S. equities ended the […]