Category: Alternative Investment Strategy

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]

Managed Futures vs. Tight Financial Conditions: Who Wins in the Battle of Investment Strategies?

Financial conditions can inform us about periods when thises and market dislocations will occur. The graph above shows the time series for the Chicago Fed adjusted financial conditions index. The index measures liquidity, risk, leverage in money, debt, and equity markets, and traditional and shadowing banking measures. If the index is positive (negative), financial conditions […]

It Is All About the Volatility Management

For many investment strategies, the difference between a good and a bad manager is based on their ability to manage risk. It is as much about how volatility is handled as return generation. A good strategy that does not manage risk well will never be successful. A key conclusion from a recent paper that focuses […]

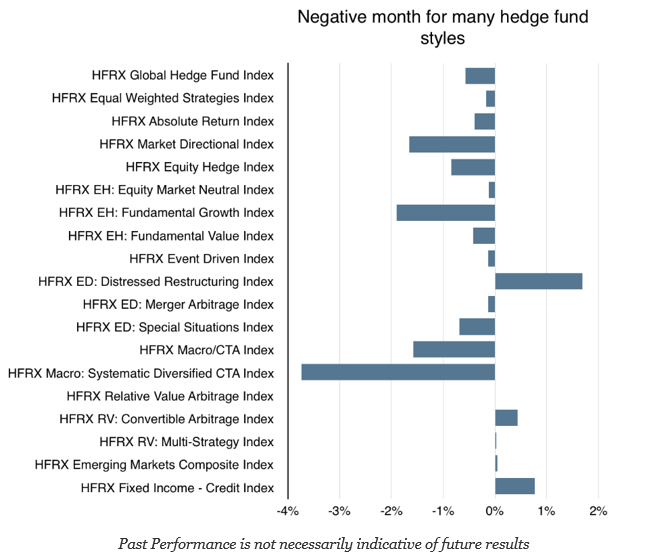

Hedge Funds

Hedge fund returns are a combination of alpha and beta risk exposure. The betas across different hedge fund styles are variable and dynamic. In general, beta will be below one, with most hedge funds showing market betas between .3 and .6. Some hedge fund styles, like managed futures, may be lower. Alpha can also be […]

Equity Hedge Funds Generate Strong Gains in September

DISCLAIMER: While an investment in managed futures can help enhance returns and reduce risk, it can also do the opposite and result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the […]

Skew Risk, Volatility Risk, and Managed Futures

Some new research on risk parity makes provocative comments on the risk and potential value of managed futures in a portfolio. In one of our previous posts, we cited this recent work suggesting that accounting for skew can be helpful relative to a risk parity approach focused on volatility. See Messy markets, mixed distributions, and skew – […]

Messy Markets, Mixed Distributions, and Skew – Thinking About Downside Risk

We often only think about markets in terms of risk and return where risk is measured by the standard deviation of returns. It is easy to calculate and update. Unfortunately, the changing nature of markets makes for messy calculations and analysis. Assuming a normal distribution is just too simple for measuring risk. Investors have to be aware of skew in return distributions. More specifically, investors have to account for negative skew because the unexpected extra downside risk is what really hurts portfolio returns.

Mitigating Losses with an Absolute Return Strategy

Absolute return strategies aim to generate positive returns irrespective of market direction. A truer more apt definition is that absolute return, or active investment management, seeks at all times to minimize losses. We mentioned this as a core attribute of an absolute return strategy in “Why an Absolute Return Strategy”, but this simple concept is worth further description.

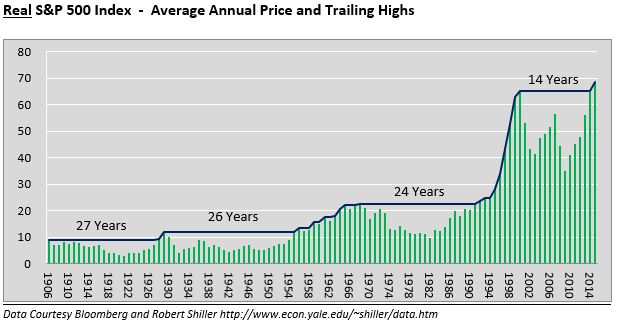

Why an Absolute Return Strategy

The first goal of investing is to increase wealth or said differently, to increase purchasing power. Warren Buffet is quoted as saying “Rule number 1 of investing is never lose money. Rule number 2 is never forget rule number 1.” The hidden message in these seemingly obvious statements is that building wealth depends much more on preventing large losses than it does on achieving large gains.

Advantages & Disadvantages of Call Options for Hedgers & Speculators

Buying (Long) a Call Option: A basic option strategy to be familiar with and learn the advantages and disadvantages of is buying a Call Option (Long Call). Buying a call option is the opposite of buying a put option in that buying a call gives you the right, but not the obligation, to buy the […]

Bulls Being Lured in With Dropping Rig Counts

CNBC is running out of credible, bullish analysts on the oil complex. The calls for $65+ WTI seem relatively sparse. Is anybody in their right mind still thinking crude oil is going higher? Of course. We all know Keynes’ saying, “The market can stay irrational longer than you can stay solvent.” But seriously, how much […]

Understanding the Long Put Option: Advantages, Disadvantages, and Trading Steps

Buying (Long) a Put Option:A basic options strategy to be familiar with and learn the advantages and disadvantages of is Buying a Put Option (Long Put). Buying a Put option is the opposite of buying a call option in that a Put gives you the right, but not the obligation, to sell the underlying futures contract at a specific […]

Oil DOE Preview: Saudi Royal Family Plays Games?

At 10:06 EST Tuesday, news broke from Dubai-based Al Arabiya that the Iranians had sieged a US cargo vessel in the Gulf. Brent and WTI spiked within minutes as the algos went wild. However, both markets failed to breach yesterday’s high. Within an hour, the market erased these gains as it turned out this was […]